Backdoor Ira Limit 2025

Backdoor Ira Limit 2025 - Backdoor Roth Limits 2025 Flora Jewelle, A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or. Backdoor Roth Contribution Limits 2025 Lois Sianna, The maximum ira contribution limit for 2025 is $7,000 for most account holders and $8,000 for those aged.

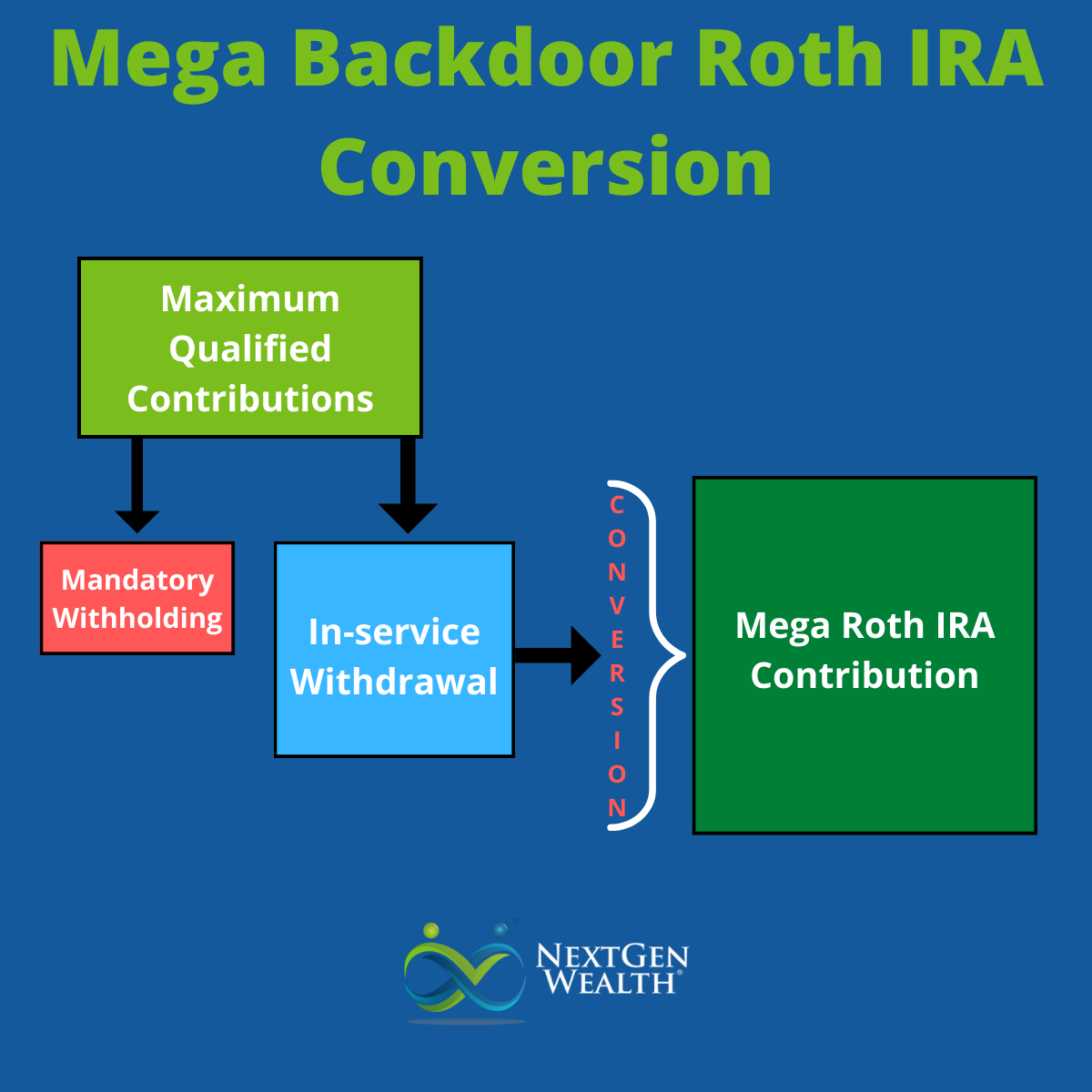

Backdoor Roth Limits 2025 Flora Jewelle, A mega backdoor roth refers to a strategy that can potentially allow some people who would be ineligible to contribute to a roth account, based on their income or.

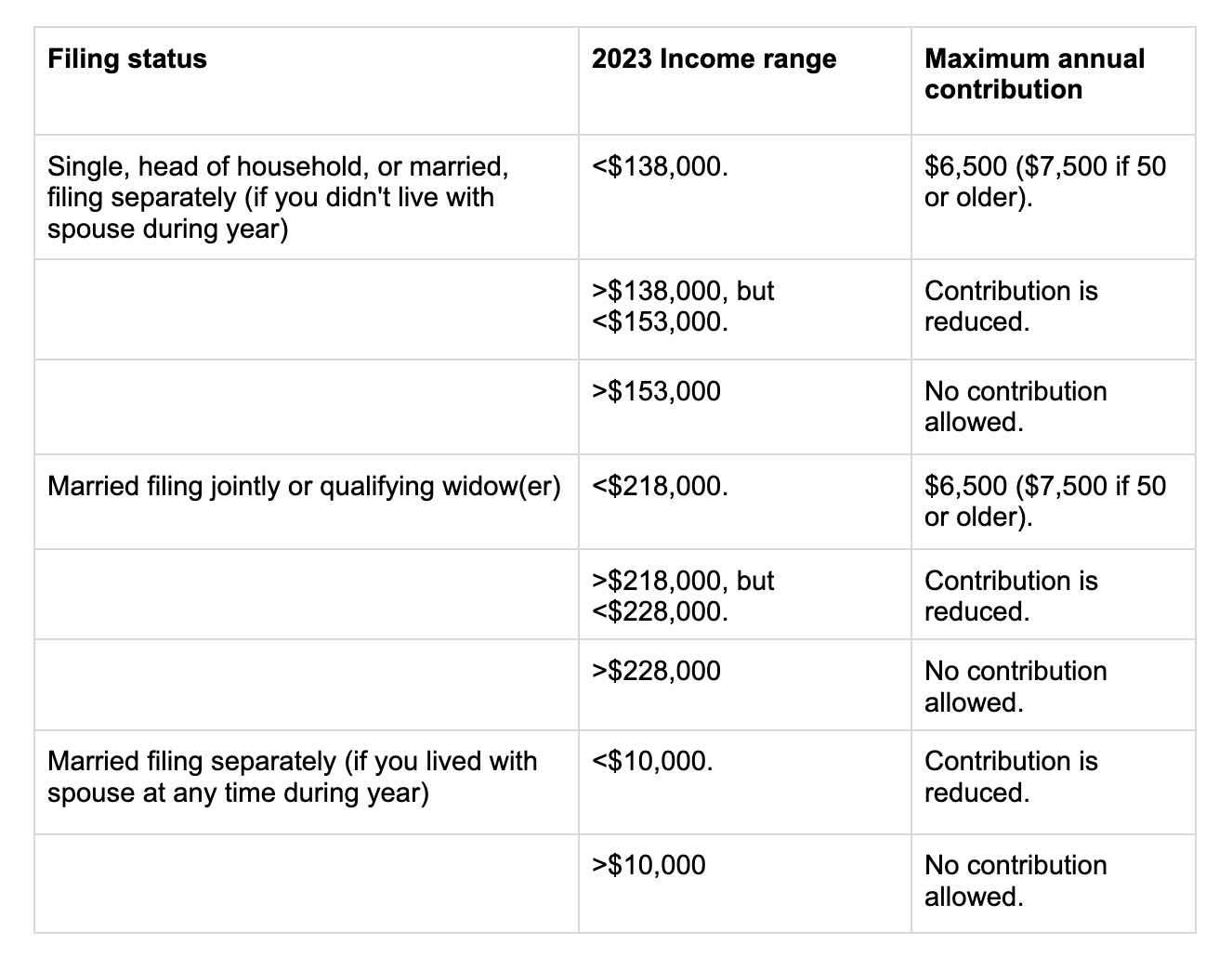

Roth Ira Conversion Rules 2025 Aubine Carroll, The ira contribution limits for a particular year govern the amount that can be contributed to a traditional ira to start the backdoor roth.

Backdoor Roth Ira Contribution Limits 2025 Catch Up Haley Keriann, How much can you convert to a backdoor roth?

Mega Backdoor Roth Limit 2025 Cris Michal, For single filers, the limit was between $138,000 and.

Backdoor Roth Ira Contribution Limits 2025 Lizzy Margarete, Depending on how you invest that money, you could see greater long.

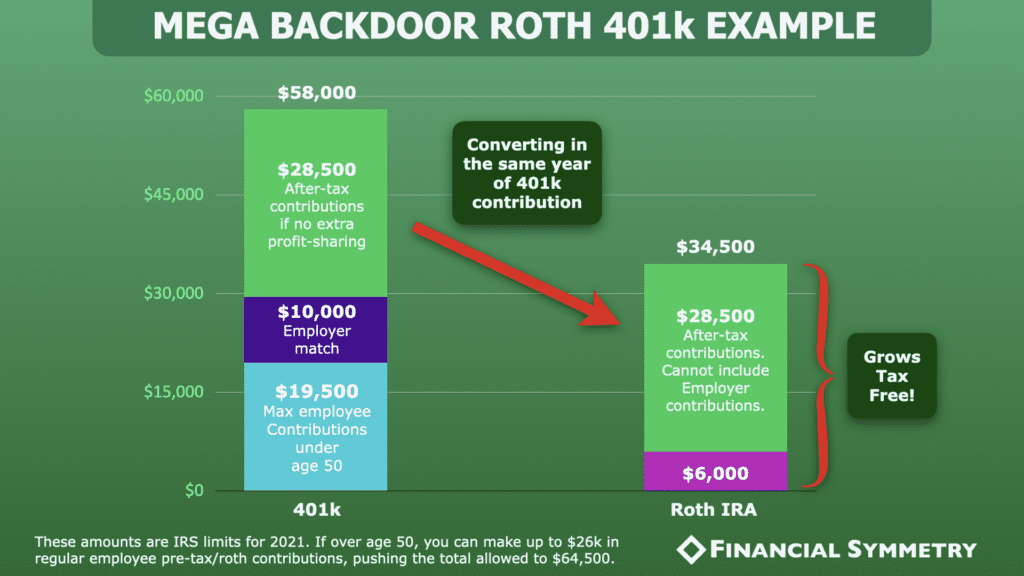

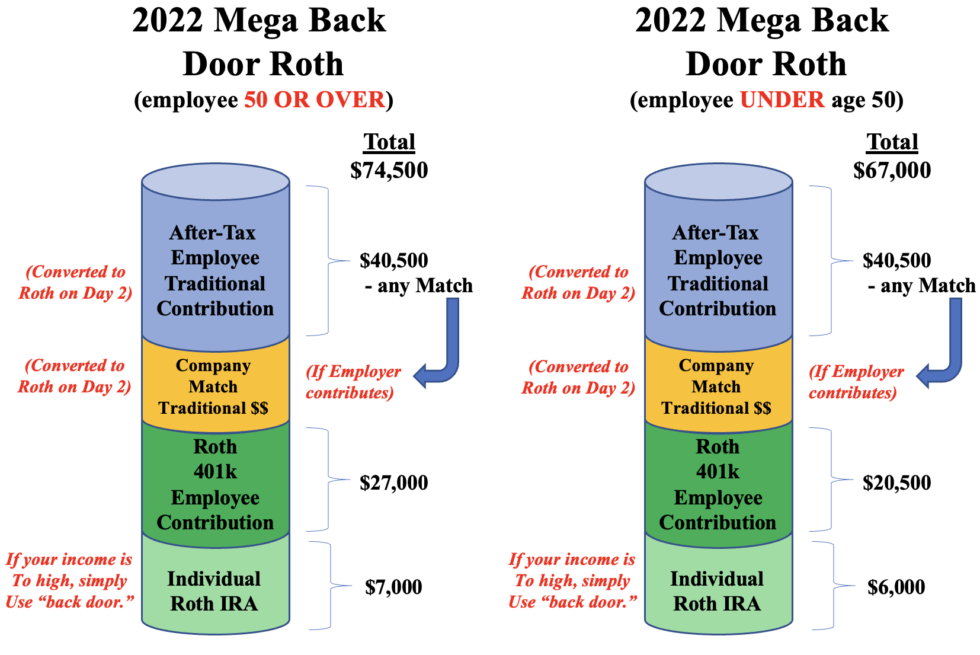

In 2025, the contribution limit is $23,000 if you’re under 50 and $30,500 if you’re over 50. In 2023, the income limit for a backdoor roth ira was between $218,000 and $228,000 for joint filers.

Backdoor Roth Ira Limits 2025 Darb Doroteya, Over the past four years, we've maximized.

Backdoor Roth Contribution Limits 2025 Lois Sianna, If your modified adjusted gross income (magi)*** for the calendar year ending december 31st 2025 is going to be above the 2025 irs upper income limits.

Backdoor Ira Limit 2025 Farah Maureene, In 2025, the contribution limits rise to $7,000, or $8,000 for.

Backdoor Ira Limit 2025. Here's how those contribution limits stack up for the 2023 and 2025 tax years. (subject to the annual deferred contribution plan limit of $69,000 for 2025, or $76,500.